What Is the Tax System for Businesses in Iraq?

What Is the Tax System for Businesses in Iraq? A Comprehensive Guide

Introduction

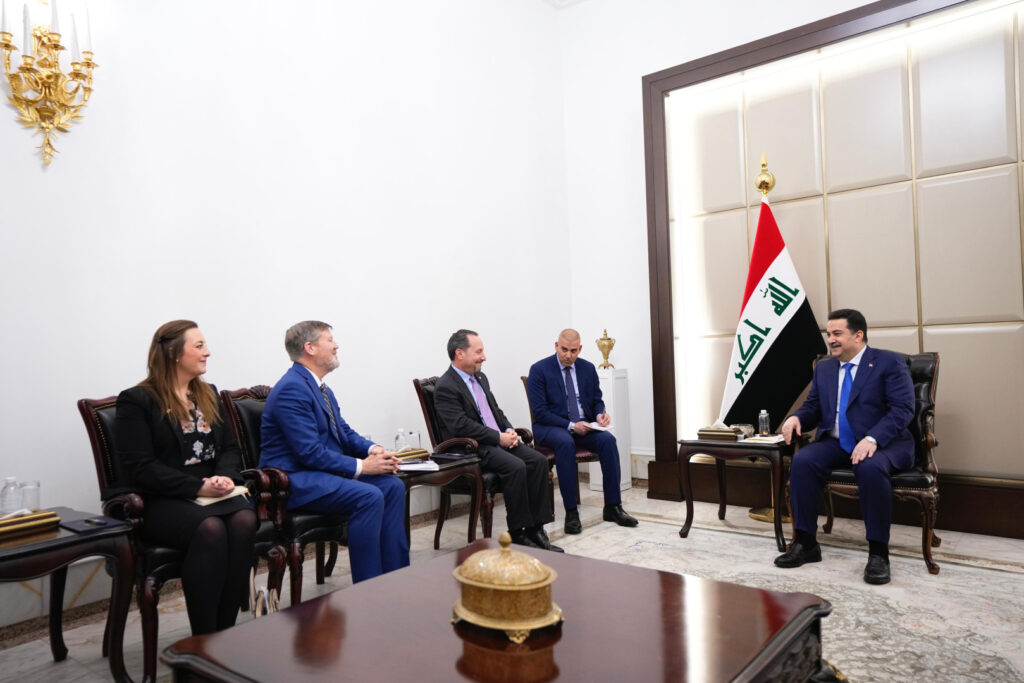

Navigating the tax system for businesses in Iraq can be complex, given the country’s unique economic landscape. Understanding the intricacies of taxation is crucial for any entrepreneur or business owner looking to engage in the Iraqi market. This article explores what the tax system for businesses in Iraq involves, highlighting current data, regulations, and practical tips for compliance and optimal tax management.

Overview of Business Taxation in Iraq

The tax system for businesses in Iraq is governed by various laws and regulations. Recent reforms have aimed to simplify the tax process and enhance compliance. Here are the key components of the tax system:

- Corporate Income Tax: In Iraq, the standard corporate income tax rate is 15% on net profits. However, different sectors may have different rates, with some industries subject to higher taxes.

- Value Added Tax (VAT): Though Iraq does not currently impose VAT, proposals for its introduction have been discussed. Keeping an eye on legislative developments in this area is vital.

- Withholding Tax: This is applied to various payments made by businesses, including dividends, interest, and royalties. Rates typically range from 15% to 40% depending on the nature of the payment.

Types of Taxes for Businesses in Iraq

Understanding the different types of taxes is essential for compliance and effective business planning.

1. Corporate Income Tax

- Rate: 15% on profits.

- Tax Base: Taxable income is calculated after accounting for allowable deductions, overhead, and costs of goods sold.

- Special Cases: Certain sectors, such as oil and gas, might have specific arrangements with higher tax rates or different stipulations.

2. Payroll Taxes

- Employers must contribute to social security and pension funds.

- The rate for social contributions is typically 12% of the employee’s salary.

3. Property Tax

- Businesses that own property are liable to pay property taxes based on the assessed value of the land or buildings.

4. Customs Duties

- Import duties vary depending on the type of goods being imported and can range from 5% to 40%.

Regulatory Framework

The current tax system is regulated by various Iraqi laws, including the Income Tax Law No. 113 of 1982 and the Companies Law No. 21 of 1997. The Ministry of Finance is responsible for the administration and enforcement of tax laws, while local tax authorities manage taxation at the provincial level.

Current Developments in Iraq’s Tax System

In recent years, the Iraqi government has made strides towards improving its tax collection and compliance. Initiatives include:

- Tax Reforms: The aim is to widen the tax base and reduce the dependency on oil revenues, which could result in new legislations affecting businesses.

- Simplification of Tax Procedures: Efforts are being made to eliminate bureaucratic hurdles that complicate tax compliance for businesses.

Practical Tips for Compliance

Understanding and navigating what the tax system for businesses in Iraq may feel overwhelming, but the following tips can help:

- Seek Local Expertise: Consulting with local tax professionals who understand the nuances of the Iraqi tax system can help ensure compliance and optimize your tax strategy.

- Maintain Accurate Records: Thorough bookkeeping can facilitate easier tax filing and help in case of audits or inquiries from the authorities.

- Stay Informed: Changes in tax law can happen unexpectedly. Regularly check updates from the Ministry of Finance or consult with your tax advisor.

- Consider Sector-Specific Regulations: Depending on your industry, there may be special tax incentives or obligations. Be sure to research your sector’s specific regulations.

Conclusion

Comprehending the tax system for businesses in Iraq is vital for entrepreneurs seeking to thrive in this emerging market. By staying informed about current regulations, engaging with local experts, and ensuring thorough compliance practices, businesses can mitigate risks associated with taxation.

The landscape is evolving, so it’s crucial to remain agile and proactive in managing your tax obligations. For further exploration of Iraqi business practices or specific inquiries about tax strategies, consider reaching out to business networks or chambers of commerce specializing in Iraqi affairs for valuable insights and support.

Call to Action

Empower your business in Iraq by mastering the tax landscape. Consider consulting with a local tax expert today to optimize your tax strategy and ensure compliance with Iraqi laws.

* * * Claim Free iPhone 16: https://itremeslo.ru/index.php?68bub2 * * * hs=767d10ac950f2f2ca23f5854ba24098b* ххх*

03rd May 2025Your comment is awaiting moderation.

5hl792