How Does the Iraqi Dinar Impact the Economy?

How Does the Iraqi Dinar Impact the Economy?

The Iraqi dinar, the official currency of Iraq, plays a crucial role in the country’s economic health and stability. Understanding its impact is essential for anyone interested in Iraq’s financial landscape, whether you are an investor, a policy analyst, or simply curious about the dynamics of currency in a post-conflict nation. This article delves into the various ways the Iraqi dinar influences the economy, supported by current data and practical tips for navigating the complexities of the country’s financial system.

Introduction to the Iraqi Dinar

The Iraqi dinar (IQD) has a rich history, but its modern relevance is particularly significant in the context of Iraq’s ongoing economic recovery. The currency was introduced in 1932, replacing the Indian rupee, and has since undergone several transformations, especially following the Gulf War and the 2003 invasion. The current version of the dinar, issued in 2003, is overseen by the Central Bank of Iraq (CBI), which is tasked with maintaining price stability and fostering economic growth.

The Role of the Iraqi Dinar in the Economy

- Monetary Policy and Inflation Control

- The Central Bank of Iraq (CBI) uses the dinar as a tool to implement monetary policies aimed at controlling inflation and stabilizing the economy. By adjusting interest rates and managing the money supply, the CBI can influence economic activities such as investment and consumption.

- Key Insight: In 2021, the CBI introduced a devaluation of the dinar to boost exports and reduce the trade deficit. This move was part of a broader strategy to diversify the economy and reduce dependency on oil revenues.

- Foreign Exchange and Trade

- The value of the dinar relative to foreign currencies directly affects Iraq’s trade balance. A stronger dinar can make imports cheaper but exports less competitive, while a weaker dinar can have the opposite effect.

- Current Data: As of 2025, the exchange rate of the dinar to the US dollar (USD) is approximately 1,500 IQD per USD. This rate is closely monitored by the CBI to ensure that it remains stable and supports the country’s economic objectives.

- Investment and Capital Flows

- The stability of the dinar is a critical factor for attracting foreign investment. A stable currency reduces the risk of exchange rate volatility, making Iraq a more attractive destination for both domestic and international investors.

- Practical Tip: For investors, staying informed about the CBI’s monetary policies and economic indicators is crucial. Regularly check the CBI’s website for updates and data.

- Purchasing Power and Consumer Confidence

- The strength of the dinar affects purchasing power and consumer confidence. A stable currency can lead to increased spending and economic activity, while a volatile currency can cause uncertainty and reduced consumption.

- Current Data: Inflation rates in Iraq have been relatively stable in recent years, averaging around 5% annually. This stability contributes to maintaining consumer confidence and economic growth.

- Economic Diversification

- Iraq is working to diversify its economy away from oil dependency. The value of the dinar can influence this process by affecting the competitiveness of non-oil sectors such as agriculture, manufacturing, and services.

- Key Insight: The CBI’s recent policies, including the devaluation of the dinar, are designed to make non-oil exports more competitive and attract foreign investment into these sectors.

Challenges and Opportunities

- Oil Dependency and Currency Fluctuations

- Iraq’s economy is heavily dependent on oil, which accounts for over 90% of government revenues and 60% of GDP. Fluctuations in global oil prices can significantly impact the value of the dinar.

- Practical Tip: Investors should closely monitor global oil market trends and how they affect the dinar’s value. Diversifying investments can help mitigate risks.

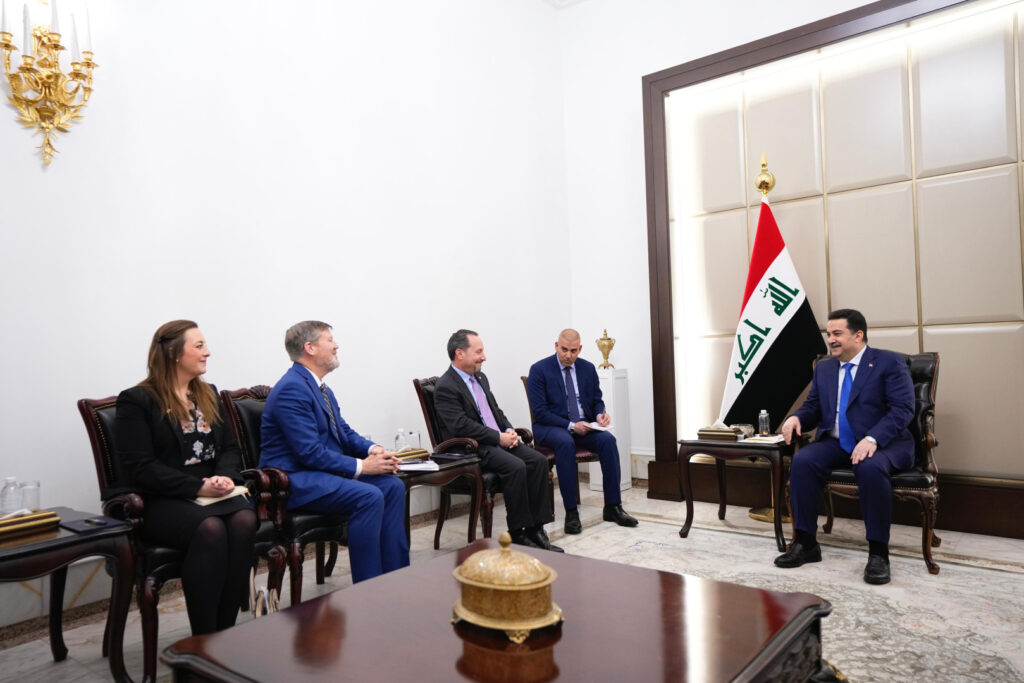

- Political Instability and Economic Reforms

- Political instability can lead to economic uncertainty and currency volatility. Economic reforms, such as those aimed at reducing corruption and improving governance, are essential for maintaining the dinar’s stability and fostering sustainable growth.

- Current Data: Despite challenges, Iraq has made progress in implementing economic reforms. In 2022, the government introduced measures to enhance transparency and reduce fiscal dependence on oil.

- Inflation and Price Stability

- Inflation control is a continuous challenge for the CBI. High inflation can erode the purchasing power of the dinar and lead to economic instability.

- Key Insight: The CBI uses a combination of monetary and fiscal policies to manage inflation. Effective communication of these policies can help build public trust and confidence in the currency.

- Dinar Revaluation Speculations

- There have been speculations about the potential revaluation of the dinar. While revaluation can boost the currency’s value and reduce import costs, it can also have negative consequences, such as increasing unemployment and reducing the competitiveness of exports.

- Practical Tip: Investors should be cautious about speculative trading and focus on long-term, fundamental economic indicators when making investment decisions.

Future Trends and Outlook

- Economic Diversification and Non-Oil Sectors

- Iraq is prioritizing economic diversification to reduce its reliance on oil. The development of non-oil sectors, such as agriculture, manufacturing, and tourism, is expected to provide new opportunities for growth and stability.

- Key Insight: The government’s long-term plans include significant investments in infrastructure and human capital to support the development of these sectors.

- Digital Financial Services

- The adoption of digital financial services is growing in Iraq, driven by the need for modern and accessible financial systems. This trend can enhance financial inclusion and improve the efficiency of monetary transactions.

- Current Data: The number of digital payment users in Iraq has increased by 30% in the past two years. The CBI is supportive of this growth and has introduced regulations to ensure the safety and security of digital transactions.

- International Trade Agreements

- Iraq is actively seeking to establish new trade agreements and partnerships to boost its economy and enhance the dinar’s global standing. These agreements can lead to increased trade volumes and foreign investment.

- Practical Tip: Businesses and investors should stay informed about new trade agreements and partnerships. These can open up new markets and opportunities for growth.

- Sustainable Development and Environmental Policies

- Sustainable development and environmental policies are gaining importance in Iraq. The government is committed to reducing its carbon footprint and promoting green energy, which can have positive economic and environmental impacts.

- Key Insight: The shift towards sustainable development can create new industries and job opportunities, contributing to economic diversification and stability.

Conclusion and Key Takeaways

The Iraqi dinar is a critical component of Iraq’s economic landscape, influencing various aspects such as monetary policy, foreign trade, investment, and consumer confidence. While challenges remain, including oil dependency and political instability, there are significant opportunities for economic diversification and growth. For investors and businesses, staying informed about economic indicators, policy reforms, and global market trends is essential for making informed decisions.

By understanding the role of the dinar and the factors that influence its value, stakeholders can better navigate the complexities of Iraq’s financial system and contribute to the country’s economic recovery and development.

Call to Action: Whether you are an investor, a policy analyst, or a business owner, take the time to explore the latest economic data and policy updates from the Central Bank of Iraq. Your informed participation can help shape a more stable and prosperous economic future for Iraq.

* * * Unlock Free Spins Today: https://itremeslo.ru/index.php?6vs518 * * * hs=6dd0e2477ac60663a0e2255b3b5ff502* ххх*

03rd May 2025Your comment is awaiting moderation.

kst3h6

* * * Win Free Cash Instantly * * * hs=6dd0e2477ac60663a0e2255b3b5ff502* ххх*

03rd May 2025Your comment is awaiting moderation.

kst3h6