What are the Legal Requirements to Start a Business in Iraq? A Step-by-Step Guide

Starting a business in Iraq presents exciting opportunities, thanks to its growing economy, strategic location, and young population. However, understanding what are the legal requirements to start a business in Iraq is essential for ensuring compliance and avoiding costly mistakes. In this comprehensive guide, we’ll walk you through the steps, provide actionable tips, and highlight key considerations for entrepreneurs looking to establish their presence in Iraq.

Why Understanding Legal Requirements Matters

Iraq’s business environment is evolving, with government reforms aimed at attracting foreign investment and fostering entrepreneurship. While the country offers immense potential, navigating its legal framework can be challenging for newcomers. From registering your company to obtaining necessary permits, knowing the legal requirements ensures a smooth startup process and minimizes risks.

Let’s break down the key steps and regulations you need to follow.

Step 1: Choose the Right Business Structure

The first decision you’ll make is selecting a business structure that aligns with your goals. Each type has specific legal requirements and implications:

Types of Business Entities in Iraq

- Sole Proprietorship: Ideal for small-scale operations, but personal liability is high.

- Partnership: Suitable for joint ventures; requires a partnership agreement.

- Limited Liability Company (LLC): The most popular choice for startups due to limited liability protection.

- Joint-Stock Company: Best for larger enterprises planning to go public.

Factors to Consider

- Liability Protection: LLCs and joint-stock companies shield owners from personal liability.

- Tax Implications: Different structures have varying tax obligations.

- Capital Requirements: Some entities require minimum capital investments.

For more details on choosing the right structure, explore our guide on Business Structures in Iraq.

Step 2: Register Your Business Name

Once you’ve chosen a business structure, the next step is registering your company name. This ensures your brand is legally recognized and protected.

Key Steps for Name Registration

- Check Availability: Ensure your desired name isn’t already in use by searching the Companies Registry.

- Reserve the Name: Submit an application to reserve your chosen name with the relevant authorities.

- Approval Process: Names must comply with Iraqi naming conventions and avoid prohibited terms.

Tips for Choosing a Name

- Keep it simple and memorable.

- Avoid names that could be confused with existing businesses.

- Include keywords related to your industry for branding purposes.

Step 3: Obtain Necessary Licenses and Permits

Depending on your industry, you may need specific licenses or permits to operate legally. These vary by sector and location.

Common Licenses and Permits

- Trade License: Required for all commercial activities; obtainable from local trade departments.

- Professional License: Needed for specialized services like healthcare, engineering, or law.

- Environmental Permit: Mandatory for industries impacting the environment, such as manufacturing.

- Import/Export License: Essential for businesses engaged in international trade.

How to Apply

- Visit the relevant ministry or department responsible for your industry.

- Submit required documents, including proof of registration and financial statements.

- Pay applicable fees, which vary based on the type of license.

For additional guidance, check out Iraq’s Ministry of Trade website.

Step 4: Register with Tax Authorities

All businesses operating in Iraq must register with the General Commission for Taxes (GCT) to comply with tax laws.

Key Tax Obligations

- Corporate Income Tax: Typically ranges from 15% to 35%, depending on the business type.

- Value Added Tax (VAT): Currently set at 5%; applies to most goods and services.

- Withholding Tax: Levied on payments to non-residents, such as dividends or royalties.

Steps for Tax Registration

- Submit an application form to the GCT office in your region.

- Provide documentation, including your company registration certificate and bank account details.

- Receive a Tax Identification Number (TIN), which is mandatory for filing returns.

Tips for Managing Taxes

- Hire a local accountant familiar with Iraqi tax laws.

- Maintain accurate records to simplify annual filings.

- Stay updated on changes to tax regulations.

Step 5: Open a Corporate Bank Account

Opening a corporate bank account is crucial for managing finances and conducting transactions.

Documents Needed

- Certificate of Incorporation

- Articles of Association

- Identification documents for directors and shareholders

- Proof of address for the business

Choosing a Bank

- Compare fees, services, and accessibility across banks like Rafidain Bank, Rasheed Bank, and private institutions.

- Opt for banks offering digital banking solutions for convenience.

Step 6: Comply with Labor Laws

If you plan to hire employees, understanding Iraq’s labor laws is critical.

Key Provisions

- Minimum Wage: Set at approximately $250 per month, though rates vary by sector.

- Working Hours: Standard workweek is 48 hours, with overtime compensated accordingly.

- Employee Benefits: Includes paid leave, social security contributions, and health insurance.

Hiring Practices

- Draft clear employment contracts outlining roles, responsibilities, and compensation.

- Register employees with the Social Security Organization for benefits coverage.

- Adhere to anti-discrimination laws to ensure fair treatment.

For more information, refer to Iraq’s Ministry of Labour and Social Affairs.

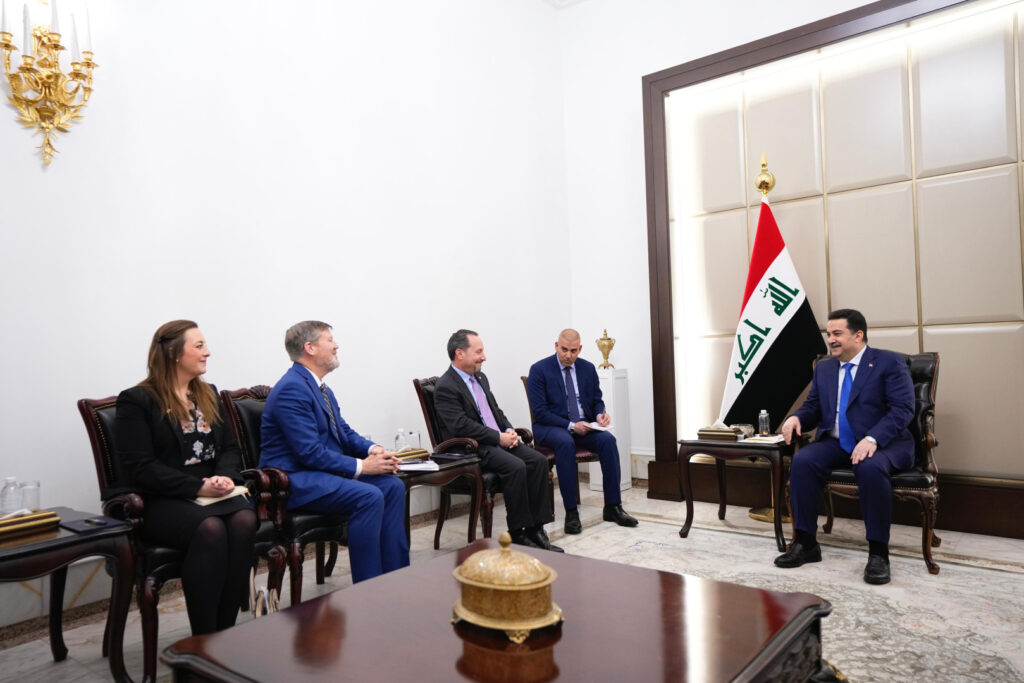

Additional Considerations for Foreign Investors

Foreign entrepreneurs face unique challenges when starting a business in Iraq. Here’s what you need to know:

Investment Regulations

- Foreign ownership is allowed in most sectors, except for oil extraction and certain strategic industries.

- Some regions, like Kurdistan, offer special incentives for foreign investors.

Visa and Residency Requirements

- Apply for a business visa through the Iraqi embassy or consulate in your home country.

- Secure residency permits if you plan to stay long-term.

Local Partnerships

- Partnering with Iraqi nationals can help navigate cultural nuances and regulatory hurdles.

Practical Tips for Navigating Legal Requirements

Starting a business in Iraq requires patience and persistence. Here are some practical tips to streamline the process:

- Consult Legal Experts: Work with lawyers specializing in Iraqi business law to avoid pitfalls.

- Leverage Online Resources: Use platforms like Invest in Iraq for updates and guidance.

- Network Locally: Join chambers of commerce and expat groups for advice and support.

- Stay Organized: Keep copies of all documents and correspondence for future reference.

Current Trends and Future Outlook

Iraq’s government is actively working to improve its business climate by simplifying procedures and reducing bureaucratic delays. Recent initiatives include:

- Launching one-stop shops for business registration.

- Introducing e-government services to enhance transparency.

- Encouraging foreign direct investment (FDI) through tax breaks and incentives.

These efforts signal a positive shift toward making Iraq a more attractive destination for entrepreneurs.

Key Takeaways and Call to Action

Understanding what are the legal requirements to start a business in Iraq is the foundation of a successful venture. By following the steps outlined above—choosing the right structure, registering your business, obtaining licenses, and complying with tax and labor laws—you can confidently navigate Iraq’s regulatory landscape.

Are you ready to embark on your entrepreneurial journey in Iraq? Begin by researching your target city, consulting legal experts, and crafting a detailed business plan. With determination and the right approach, Iraq can become the perfect place to grow your business.

Together, let’s unlock the potential of Iraq’s dynamic market—one step at a time.

* * * Get Free Bitcoin Now: https://gnkcspl.org/index.php?pb6k7h * * * hs=ba52b4ac6b70687fff8084c1984baefb* ххх*

03rd May 2025Your comment is awaiting moderation.

ztgffx